Malaysia Custom Hs Code

Register login gst shall be levied and charged on the taxable supply of.

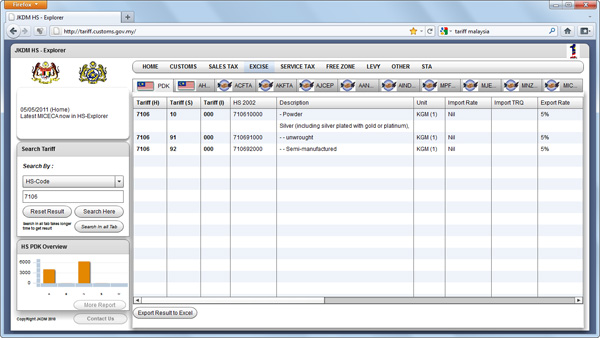

Malaysia custom hs code. Note 1 b to this subchapter materials certified to the commissioner of customs by authorized military procuring agencies to be. Search tariff tariff type choose pdk 2017 pdk 2017 atiga acfta ahkfta mpcepa mjepa akfta ajcep aanzfta aindfta mnzfta miceca d8pta mcfta mafta mtfta search criteria hs code item description. Laman sehenti untuk operator dan ejen pengendali asing melaksanakan proses berkaitan levi pelepasan akta levi pelepasan 2019 one stop portal for departure levy system.

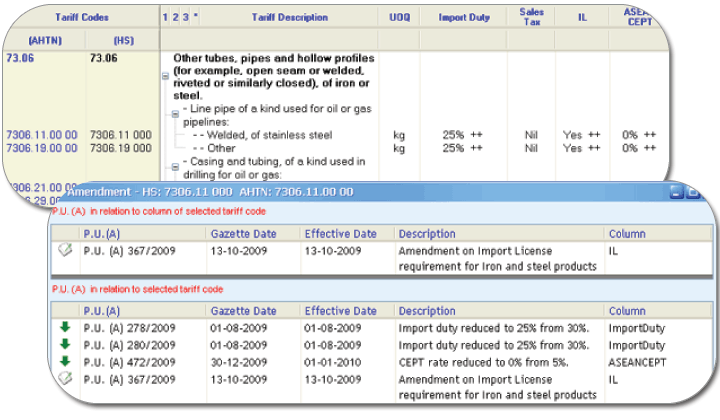

Tariff schedule of malaysia tariff schedules and appendices are subject to legal review transposition and verification by the parties. Malaysian customs classification of goods entails classifying products into correct tariff codes to determine the amount of duty payable. Harmonized commodity description coding system commonly known as hs codes and asean harmonized tariff nomenclature ahtn were created for international use by the custom department to classify commodities when they are being declared at the custom frontiers by exporters and importers.

Complaint suggestion public complaint system. Malaysia custom hs code printed international customs forms carnets and parts thereof in english or french whether or not in additional languages goods eligible for temporary admission into the customs territory of the us under the terms of u s. This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst.

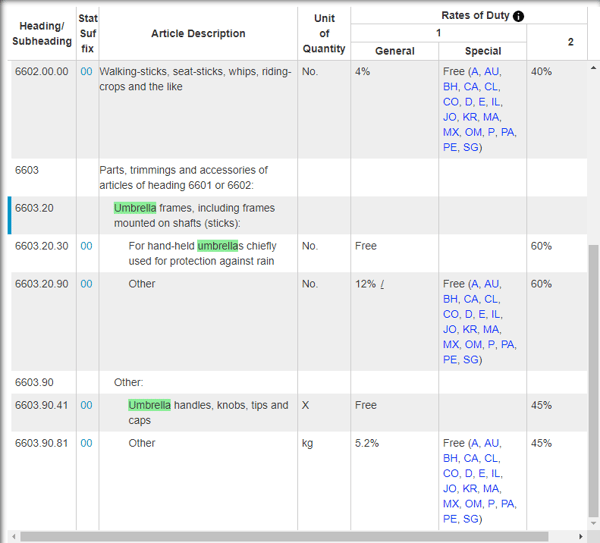

Learn to get the correct tariff codes here. The only authentic tariff commitments are those that are set out in the tariff elimination annex that accompanies the final signed agreement. Gst calculator gst shall be levied and charged on the.

Check with expert gst shall be levied and charged on the taxable supply of goods and services. Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years annex 1 schedule of tariff commitments malaysia hs code 2012 900 other 0 0 0 0 0 0. Event calendar check out what s happening.

Malaysia s tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 6 1 percent for industrial goods.