Malaysia Import Duty Exemption

This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst.

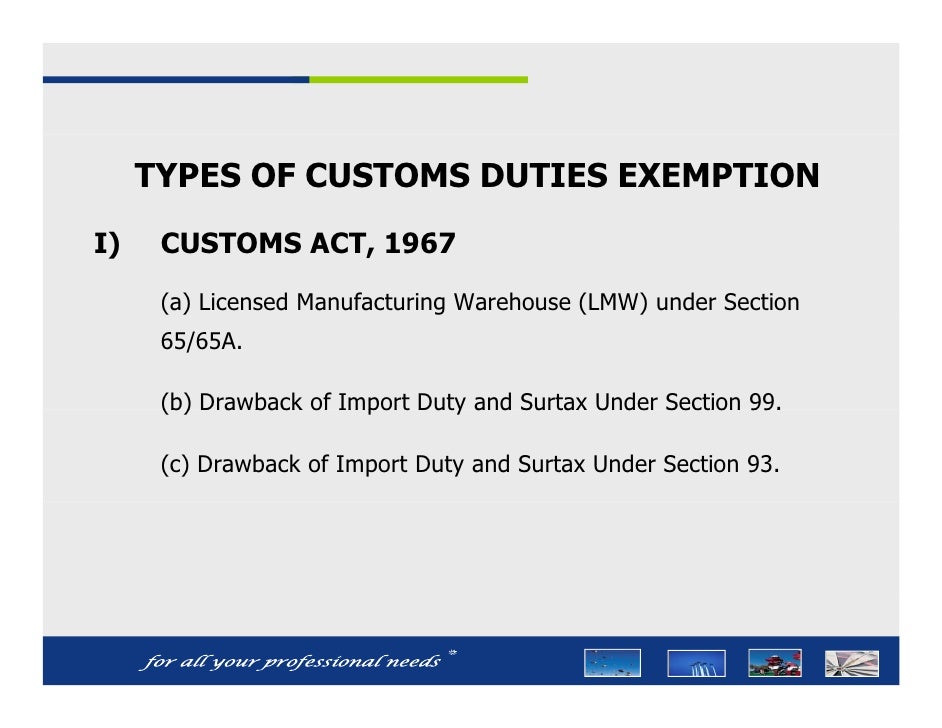

Malaysia import duty exemption. The total gst amount as reflected in the import permit and short payment permit. Sales tax 2018 guide on. These acts cover investments in the manufacturing agriculture tourism including hotel and approved services sectors as well as r d training and environmental protection activities the direct tax.

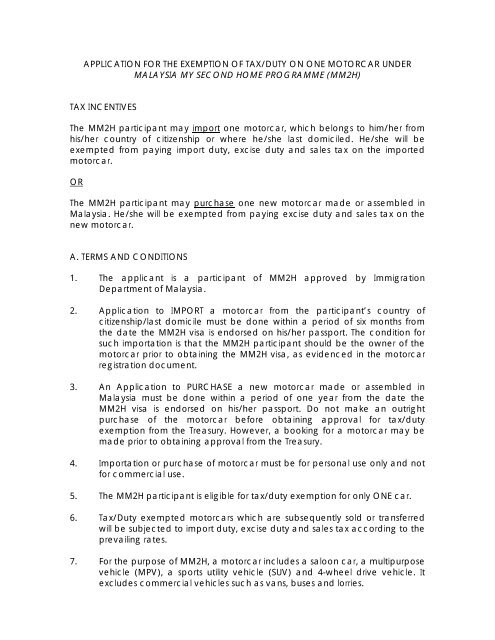

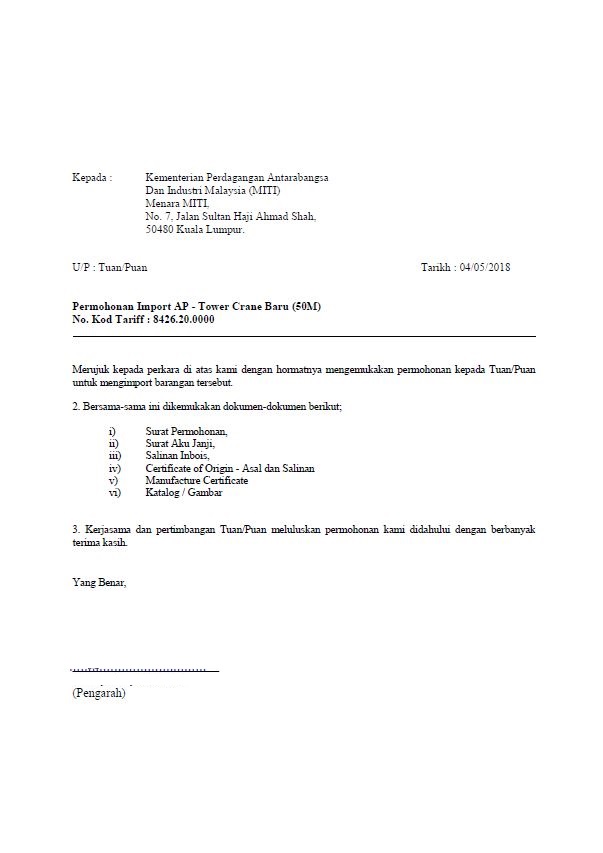

Trying to get tariff data. What is excise duty. Manufacturers in principal customs area pca companies engaged in hotel business haulage operators and aerospace maintenance repair and overhaul mro companies can be given exemption on import duty and or sales tax on machinery equipment spare parts prime movers container trailers specialised tools components materials or specialised consumables goods.

Authorised economic operator aeo asean customs transit system acts free zone. Royal malaysian customs department internal tax division putrajaya 28 august 2018. Apply for excise duty credit and drawback.

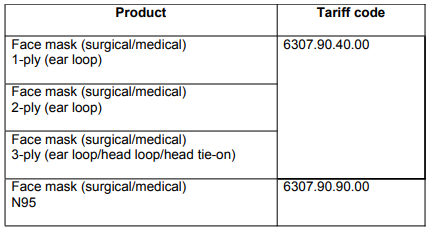

In malaysia tax incentives both direct and indirect are provided for in the promotion of investments act 1986 income tax act 1967 customs act 1967 excise act 1976 and free zones act 1990. Hak cipta terpelihara 2018 jabatan kastam diraja malaysia. The government is cognisant of the difficulties faced by the rakyat in obtaining face masks due to the sharp rise in demand said its minister tengku.

Under declaration of value or quantity on exemption permit if you have under declared the value or quantity of ipm imports in your exemption permit you need to take up another exemption permit to declare the short fall in the value or quantity. Kuala lumpur march 23 the ministry of finance mof has approved the import duty and sales tax exemption on face masks for the domestic market. Customs duties exemption order 2017.

Exemptions published by.