Malaysian Tax Rate 2016

Corporate tax rate in malaysia averaged 26 21 percent from 1997 until 2020 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015.

Malaysian tax rate 2016. The 2016 budget proposals were presented by the country s prime minister yab dato sri mohd najib tun haji abdul razak on 23 october 2015. What is tax rebate. What is income tax return.

This page is also available in. How does monthly tax deduction mtd pcb work in malaysia. This page provides malaysia corporate tax rate actual values historical data forecast chart statistics economic calendar and news.

Malaysia personal income tax rates two key things to remember. The corporate tax rate in malaysia stands at 24 percent. How to pay income.

However schedule 3 of the income tax act 1967 has laid down several allowable deductions in the form of allowances for the capital expenditures that have been incurred. You will never have less net income after tax by earning more. Tax rates are progressive so you only pay the higher rate on the amount above the rate i e.

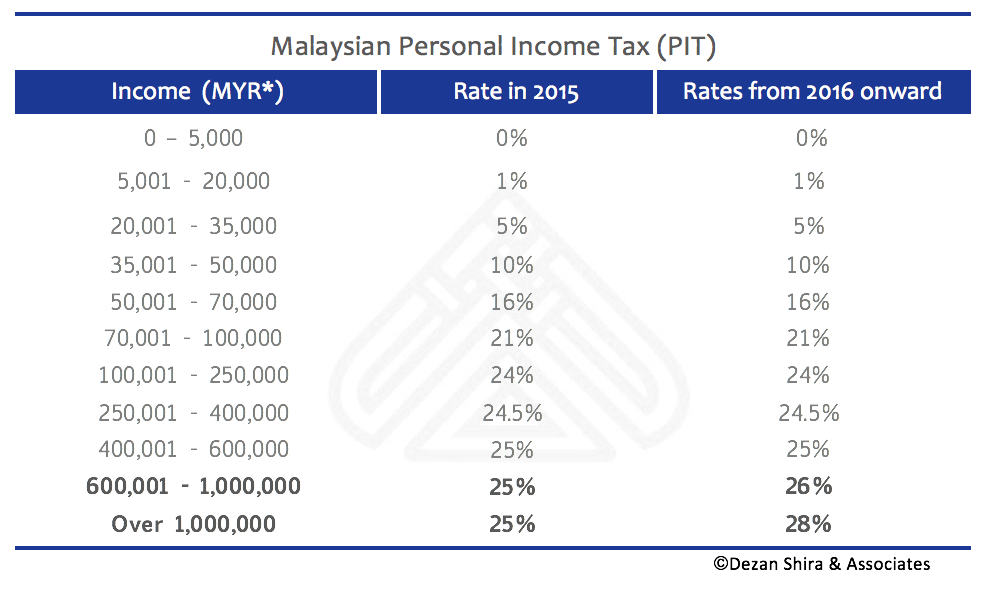

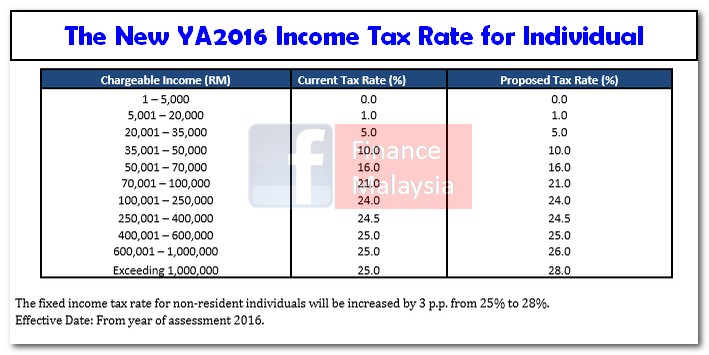

2016 2017 malaysian tax booklet. The information provided in this booklet is based on taxation laws and other legislation as well as current practices including legislative proposals and measures contained in the 2017 malaysian budget announced on 21 october 2016. W e f ya 2016 tax rates for resident individuals whose chargeable income from rm600 001 to rm1 000 000 be increased by 1 and chargeable income exceeding rm1 000 000 increased by 3.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Capital allowances consist of an initial allowance and annual allowance. Malaysia income tax e filing guide.

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar.

A qualified person defined who is a knowledge worker residing in iskandar malaysia is taxed at the rate of 15 on income from an. Malaysia taxation and investment 2016 updated november 2016 contents 1 0 investment climate 1 1 business environment 1 2 currency 1 3 banking and financing 1 4 foreign investment 1 5 tax incentives 1 6 exchange controls 2 0 setting up a business 2 1 principal forms of business entity 2 2 regulation of business.